GST34 2 E 12 PDF

Ontario Annual Return: Understand its importance for corporations in Ontario, learn about filing deadlines, and grasp the implications of non-compliance in our comprehensive overview.

1009a Fill out & sign online DocHub

The requirement to file an Annual Return is in addition to a requirement to file any income tax returns and exists even where a corporation earns no taxable revenue. The Annual Return itself includes the corporation's legal name, mailing address, taxation year end date, date of incorporation or amalgamation, corporation number, jurisdiction.

Apply FSSAI Licence for Food business in India

Prior to May 15, 2021, Ontario corporate annual returns, required under the Ontario Corporations Information Act, were filed with the Canada Revenue Agency (CRA) as part of the annual T2 Corporation Income Tax Return.Effective May 15, 2021, CRA and the Ontario government announced that annual returns, which confirm and update certain basic corporate information, would no longer be filed as.

What is an Ontario Annual Return? Ontario Business Central Blog

Filing your corporation's annual return in Ontario for staying compliant. Learn how to avoid costly penalties with our step-by-step guide.

File hst online Fill out & sign online DocHub

The Ontario Annual Return is a document filing required by all Ontario corporations to submit an updating listing of the corporate details with the province of Ontario. This is mandatory for each existing corporation, even when no changes have occurred since the previous annual return submission.

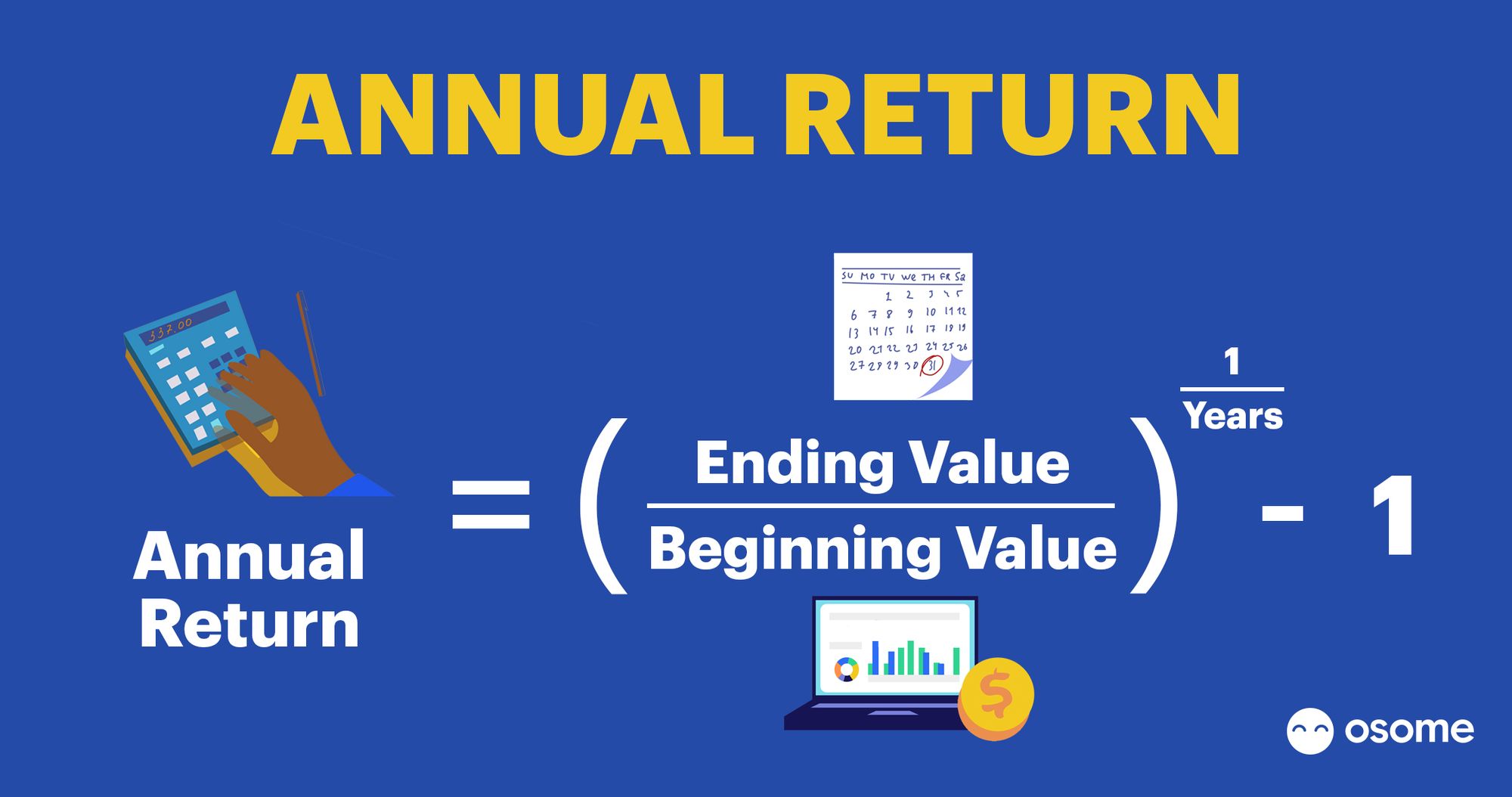

Annual Return

Notice - Corporations Information Act - Filing an Annual Return Ministry Delivering vital programs, services, and products — ranging from health cards, driver's licence and birth certificates to consumer protection and public safety — to help create.

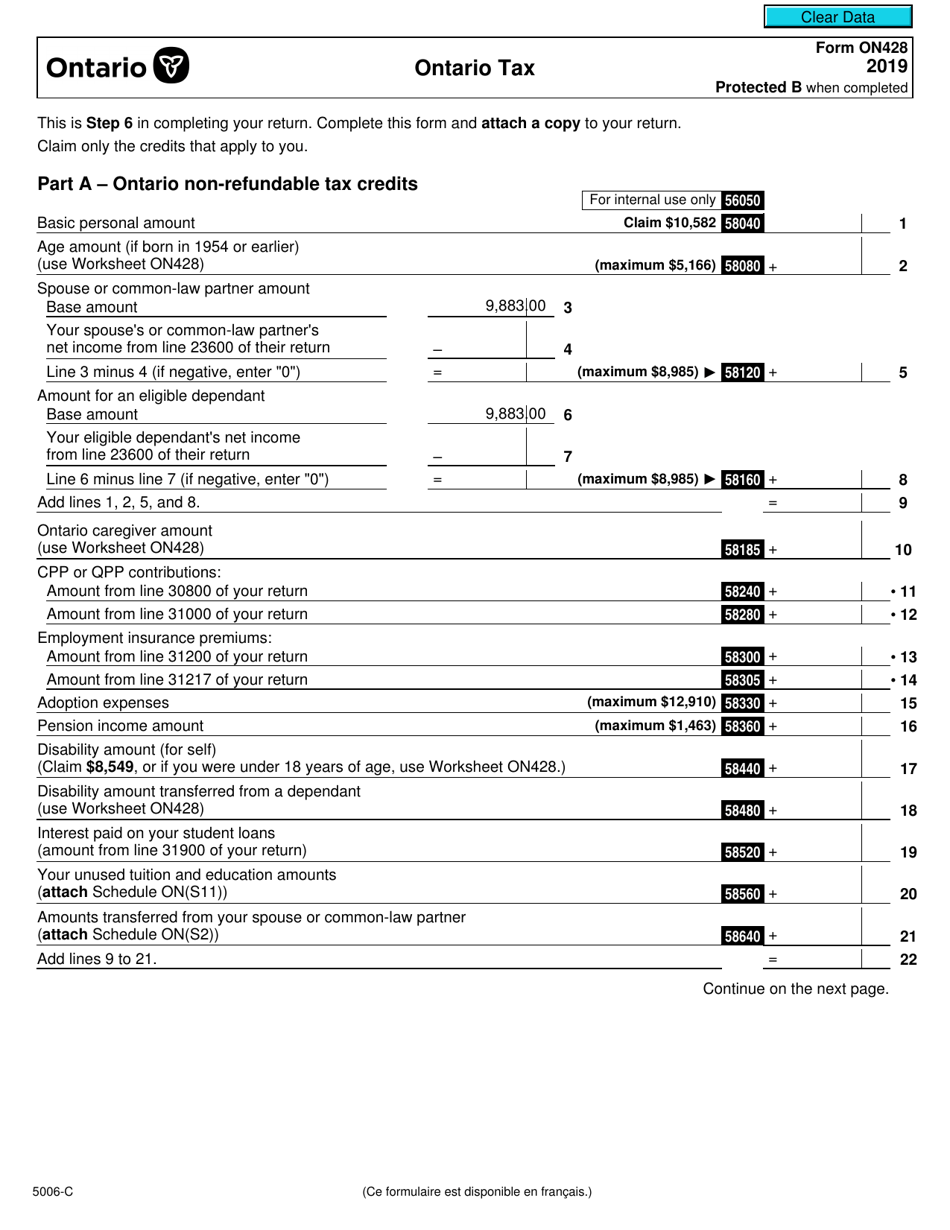

Form ON428 (5006C) 2019 Fill Out, Sign Online and Download Fillable PDF, Canada

To file your corporation's annual return, go to the corporation's registry profile and select the "Make Changes" drop-down list. On that drop-down list, you will find the option to file an annual return. Access your corporation's Ontario Business Registry profile. Company information

Annual Return

To file an annual return in Ontario, a corporation should collect all necessary information including the corporation's name, Ontario Corporation Number, registered office address, director details, financial year-end date, business type, and share classifications. These details are submitted through the Ontario Business Registry.

Annual Return

Ontario Annual Return filing through Business Ontario. Select the years: The first step is to select the year that you want to file. If you are filing two years at once, please ensure to choose the correct quantity (years) to reflect the number of years you're filing for. The cost shown is per year. Write any changes:

Learn How to File A PoSH Annual Report KelpHR

Notice - Corporations Information Act - Filing an Initial Return and Notice of Change - Ontario Corporations Effective Date: This Notice is to be effective on the day that section 85 of Schedule 6 to the Cutting Unnecessary Red Tape Act, 2017 comes into force. 1. How to File an Initial Return or Notice of Change Online 2.

Annual Return Filing in Hong Kong A Complete Guide HKWJ Tax Law

File Your Returns. Select the company you want to file the Annual return for, then click on Make Changes and File Annual Return. The next steps are to follow each screen and confirm that the information that Ontario has on file is correct. Make any changes needed and then submit it. There is no cost to file this return and it will not affect.

Ontario Annual Information Return Stern Cohen

Once the Service Ontario account has been activated, an entity will be able to file their annual information return online. We recommend that businesses contact their lawyer prior to filing the Ontario annual information return online. For more information, please visit the Service Ontario website or call 416-314-8880 (Toronto)/1-800-361-3223.

Annual Return

This video provides a tutorial on how to file an annual return through the Ontario Business Registry website. If you are incorporated in the province of Onta.

Incorporation Alberta IncorpRegistry

Deadlines for Filing Annual Returns. Ontario corporations must file their annual returns within 60 days following the corporation's anniversary date (i.e., the date the corporation was incorporated or amalgamated). Failure to file the annual return within the deadline may result in penalties and potentially the dissolution of the corporation.

How to file annual return Practical guide

Ontario corporations annual return filing Background. On October 19, 2021, Ontario launched the Ontario Business Registry (OBR), which replaced the previous registry system that had existed for almost 30 years. The OBR is intended to provide instant fulfilment of search and registration requests and to operate 24 hours per day.

Singapore Company’s Annual Filing Requirements ACRA & IRAS

Click 'Accept' to agree to the Terms and Conditions. Complete the Annual Return. Provide your contact information. Indicate the year you're completing for. Indicate what your primary business activity is. Enter your official email address. Click 'Save and Continue'. Confirm or update the registered business address. Click 'Save and.