How Mortgage Lenders Evaluate Applicants in Canada YouTube

CMHC and Super Brokers Working in Tandem. Super Brokers is proud to work with a variety of approved Canadian Lenders. We do this to ensure that the best financing options are available to each homebuyer that we help. Anything less can make the entire process harder and makes it tougher than it needs to be.

lenderslist Utmost Pro, Inc

As of April 25, 2024 at 03:59 p.m. ET, the lowest rate for a 5-year fixed mortgage is 4.69%, for a 3-year fixed mortgage is 4.79%, and for a 5-year variable mortgage is 5.90%. Compare rates from over 40 lenders in Canada and get the best mortgage rate.

Ice Developments Build Canada Magazine

Most mortgages are lent through Canada's Big Six Banks: RBC, TD, Scotiabank, BMO, CIBC, and National Bank. RBC mortgages make up 27.4% of Canada's $992 billion mortgage market, making the Royal Bank of Canada the largest mortgage lender in the country. These "A Lenders", along with other chartered banks, have relatively strict criteria.

List of Alternative Mortgage Lenders Canada TurnedAway.ca

Innovation, Science and Economic Development Canada administers the CSBF Program through a network of private-sector lenders in all provinces and territories. Lenders are responsible for all credit decisions, making the loans, providing loan funds, and registering the loans with Innovation, Science and Economic Development Canada. Lenders are also responsible for the administration of loans.

VA Mortgage Lenders, Canada's Mortgage Lenders Mortgage Forces

With such a bustling real estate market comes a multitude of mortgage lenders for homebuyers to choose from. Naturally, Canada's Big 6 Banks (RBC, TD, Scotiabank, CIBC, BMO, and National Bank) operate in Ontario and are also the largest lenders in the province. The Big Six held 72.99% of all mortgages in 2023, as reported by the federal government's Canada Mortgage and Housing Corporation.

100 Lenders review 3 easy steps to get a loan! The Post New

Most lenders look at your credit score before approving you for a mortgage. Aim to have a credit score of at least 660, while scores 759 or higher usually qualify for the best rates. The minimum credit score to get a mortgage depends on the type of loan you're getting. Calculate your debt-to-income (DTI) ratio.

The Mortgage Insurance Market & Wholesale Lenders Pinsky Mortgages

BMO is one of Canada's biggest banks and also one of its biggest mortgage lenders. BMO offers the longest rate hold of any major bank, promising to secure its best rate for 130 days while you.

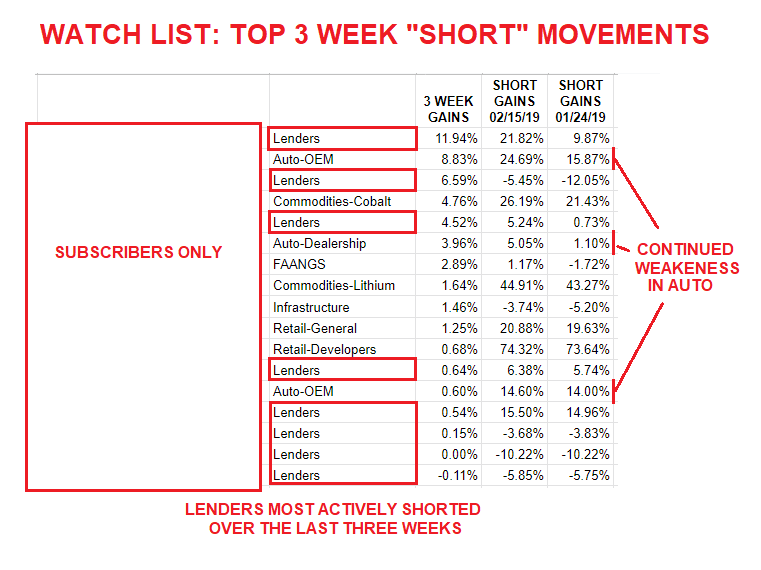

MATASII WATCH LIST LENDERS SHOW STRONGEST “SHORT” MOVEMENT OVER LAST THREE WEEKS MATASII

A mortgage lender can be an institution, bank, trust, credit union, corporation or individual that lends money secured against a property. In Canada, mortgage lenders can be federally regulated financial institutions (FRFI), provincially regulated lenders and credit unions, or registered private lending syndicates.

5 Ways to Evaluate the VA Lenders on Your List YouTube

Methodology. We reviewed 82 popular lenders based on 17 data points in the categories of loan details, loan costs, eligibility and accessibility, customer experience and the application process.

Mortgage Lenders in Washington

Here's a list of 15 of the best mortgage lenders in Canada: 1. Neo Financial. Best for Convenient Digital Mortgages and Competitive Rates. Neo Financial is a fintech company that provides various financial services, including banking and mortgages.

One of Canada’s Biggest Private Lenders to Sell 11 of Loan Book Bloomberg

Best mortgage lender for residential mortgages. Quick facts. Nesto, which was founded in 2018, refers to itself as "Canada's first digital mortgage finance company". Nesto team is salaried.

One of Canada’s Largest Private Lenders Halts Redemptions Bloomberg

Many mortgage lenders in Canada provide solutions for borrowers to obtain a mortgage. Choosing between an A or B lender is less about which option provides the better rate and more about the most suitable mortgage solution that matches your financial situation and risk tolerance. Whether you're a first-time buyer, self-employed, or unable to.

About ApproveU.ca

B lenders are financial institutions which cater to people who do not fit in the A lender category. This might include people with low credit scores, new Canadians who have not yet built a credit history, or those with incomes that do not qualify them for mortgages at the A lender institutions. B lenders will usually charge a lender's fee.

Guaranteed approval loans Bad credit private lenders Canada

Loans Canada. Amount: $500 - $35,000 Rate: 2.99% - 46.96% Term: 4 months - 5 years (or more) Loans Canada is not a private lender, but an online lending platform that connects borrowers with private lenders across Canada. The company provides access to a range of loan products, including personal loans, business loans, debt consolidation.

Vol 1 Vendor List Lenders Real Estate Etsy

Loans Canada places No. 228 on The Globe and Mail's fifth-annual ranking of Canada's Top Growing Companies. By Caitlin Wood, BA Published on September 29, 2023. Loans Canada is excited to announce it has made it onto the Globe and Mail's Top Growing Companies list for the second year in a row.

Lenders Choice Credit Solutions Credit Builder Card

Fairstone was a finalist in the Best Personal Loan Alternative Lender category in the Finder: Personal Loans Best-in-Class Awards 2024. Flexible options. Borrow as little as $500 and as much as $50,000 with terms from 6 - 120 months. Apply online or in person.